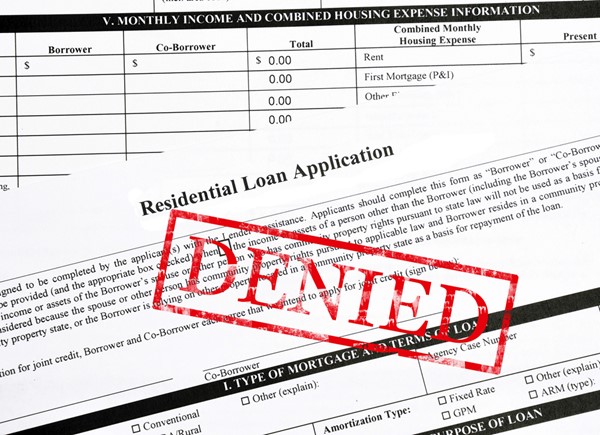

A wise man once said to hope for the best, but plan for the worst. When you’re contemplating buying a house, even before beginning the actual application itself, it’s helpful to consider what could possibly lead to its rejection. This is especially important if you’ll be applying for your home loan at a traditional bank. These are particularly finicky with whom they give house loans after the 2008 financial crisis. So, here are a few pitfalls you need to sidestep when filling in your application forms.

Sketchy job history

In order to be sure you’ll be able to pay them their money back, lenders like to get a picture of a steady flow of income in the near future from applicants. You won’t help this cause if your job history reads like a game of musical chairs. Or if there are gaps in your recent past where you had no source of income. Mortgage officers like to see some sort of stability in the income streams of applicants. If they don’t get that impression, your pre-approval might not see the light of day.

In that vein, be sure to document your income streams and assets well in anticipation of the day you will be making that application. This preparation could be the difference between approval and rejection.

Low credit score

A low credit score can be as a result of unpaid debt or debts that you eventually paid up but didn’t update on your FICO records. Either way, if your score is lower than 620, lenders will consider approving your mortgage a risky investment. A low credit score should not, however, spell death to your dreams of owning a home. Get your credit score from one of the many available online sources and see how you can improve it. After a couple of months, you will find yourself eligible for that mortgage.

Outstanding tax liens

An unpaid tax lien or judgment from the past that you may have forgotten about may negatively affect your application. It may not be a problem in the initial stages, but at the point when your lender does a title search for the property, unpaid federal or state tax liens will surface. A clear title policy cannot be issued with outstanding tax liens or judgments.

Find out your FICO score for free online and talk to your lender to determine the best course of action for you.

About the Author